The Benefits of Mobile Banking

There’s little arguing that smart phones have been one of the most impactful inventions in human  history. Their purchase and use exceeds PCs and continues to accelerate. The impact of smart phones, as well as tablets, can be felt in just about every facet of daily life in terms of how we communicate, gather information, shop, access entertainment, and of course, how we bank.

history. Their purchase and use exceeds PCs and continues to accelerate. The impact of smart phones, as well as tablets, can be felt in just about every facet of daily life in terms of how we communicate, gather information, shop, access entertainment, and of course, how we bank.

What is mobile banking?

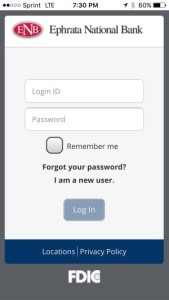

Mobile banking allows a bank’s customers to perform many, if not all, of the same transactions they would perform using a browser on their PC. This includes checking account balances, transferring funds, viewing transactions and statements, paying bills and setting up account alerts. In addition, many banks provide customers with the ability to deposit checks. All of this is done through an app that is downloaded to your smart phone or tablet from your provider’s app store. The app makes navigation much easier than if you were trying to use online banking through the browser on your phone.

Is it right for me?

The answer to that question is really a matter of personal preference. Some people are more comfortable sitting at a desk with a personal computer and keyboard. Others appreciate the flexibility mobile banking provides by allowing them do their banking anytime, anywhere. At ENB, we’re noticing that navigation and user-friendliness of online vs. mobile banking have an impact on a consumer’s preference. In response, we now offer a unified user experience so the navigation, layout and design of mobile and online banking are the same regardless of whether you are using a browser or app on your PC, smartphone or tablet.

Is it Safe?

As with online banking, mobile banking uses security protocols such as information encryption, multi-factor authentication, and behavioral analytics to protect customers.

So, if you believe mobile banking is right for you, or would like to learn more, click here, contact us or stop by any of our 12 branch offices.